Newsletter

The Rainmakers of the Crypto Market

Introduction

This week’s newsletter focuses on protocols (blockchains & decentralized applications) that generate the most fees. Understanding which protocols that generate the most fees is interesting for a few different reasons:

- Which protocols' services are users willing to pay for?

- What services do these protocols provide and how do they charge their users (business model)?

- How much are the users actually paying?

- Are some market sectors more popular than others?

- Is there a dominant protocol within these market sectors?

We’ll learn that analyzing only one chart from the Terminal can tell us a lot about the industry dynamics in the crypto market.

Let’s dive in!

1. Top fee-generating protocols with a highlight on Blockchains

A majority of Fees is generated by general-purpose blockchains

- Of the top 20, 5 are L1 blockchains, while only 1 is an L2 blockchain.

- In the past 30 days, Ethereum generated the most Fees (~$180M). It’s worth highlighting that Base, despite the relatively low average transaction fee of ~$0.03 (compared to ~$4.5 on the Ethereum L1), still places among the top 20 because of the surge in user activity on the L2.

- Outside of L1 & L2 blockchains, all the other protocols in the top 20 belong to the DeFi category.

2. Top fee-generating protocols with a highlight on Lido Finance and Jito

Lido generates the most Fees out of all applications in crypto

- Jito runs 2 different businesses: liquid staking (JitoSOL) and an MEV marketplace. The former monetizes via an AUM based management fee, and the latter by a take rate on the MEV tips paid to validators (the above chart includes only the MEV tips). Lido runs 1 business: liquid staking. It monetizes by charging a take rate on the staking rewards it earns for its depositors.

- Lido generates ~2x in Fees compared to Jito, but Jito is growing faster.

- Lido has $33.5B in Assets staked, whereas Jito has $1.6B. Lido’s fully diluted market cap is $1.9B, whereas Jito’s is $2.5B.

3. Top fee-generating protocols with a highlight on Exchanges (DEX)

The Uniswap DAO dominates the DEX category with monthly Fees nearing $100M

- The Uniswap DAO generates the most Fees among DEXs. Note that Uniswap Labs is included as a separate entity, it monetizes by charging users who access the Uniswap Protocol through the official Uniswap Labs frontend application.

- Uniswap DAO generates over ~2x in Fees compared to all the other DEXs in the top 20.

- Aerodrome, a Base-native DEX, generates ~2x more fees than its underlying L2 blockchain.

4. Top fee-generating protocols with a highlight on MakerDAO and Ethena

Ethena is on track to overtake MakerDAO in Fees

- MakerDAO and Ethena dominate the decentralized Stablecoin issuers category.

- The biggest stablecoin issuers, Tether (USDT) and Circle (USDC) are not included as they earn their Fees & Revenue offchain.

- Ethena was launched in November 2024, whereas MakerDAO was launched already in November 2017.

5. Top fee-generating protocols with a highlight on Lending protocols

Aave is the 4th most fee-generating application in crypto

- Aave is the clear market leader in the lending category, with a ~$30M Fee gap to Morpho, which comes in 2nd place in the lending market sector.

- Compound and Aave both launched in 2020, but Aave has since managed to outcompete Compound in terms of Active loans and Fees.

- Despite Aave’s dominance in the lending category, Venus stands out as the clear market leader for lending on the BNB Chain. Right now, ~90% of Venus’ Fees are generated from its deployment on the BNB Chain.

6. Top fee-generating protocols; breakdown by chain

Most of the top fee-generating applications are deployed to multiple blockchains

- A vast majority of the top 20 fee-generating applications in crypto have a deployment on Ethereum (L1 and L2s).

- It is worth noting that asset issuers (Stablecoin issuers and Liquid staking providers) tend to be governed from a single chain, while their core product (stablecoin or LST) is made available as a bridged asset on multiple other chains.

- Of the top 20, Aerodrome is the only application that has been launched from an L2 blockchain (Base).

FAQ

What are Fees?

- The aggregate fees paid by the end users of the protocol’s service.

- The methodology for Fees varies between Market sectors, because protocol’s in different Market sectors tend to have different business models:

- Blockchains L1 & L2 = sell blockspace for transaction fees

- Liquid staking = invest users’ stake to earn staking rewards

- Exchange (DEX, Derivatives) = enable asset exchange against trading fees

- Lending = provide loans against interest payments

- Stablecoin issuers = provide access to USD against interest payments and/or invest user deposits to earn yield

- Asset management = invest user deposits to earn yield

What’s the difference between Fees and Revenue?

- Revenue is calculated based on the take rate (%) that the protocol applies to Fees.

- The take rate can be anything between 0-100%.

- Currently, the Uniswap DAO and Bitcoin both have a take rate of 0%, whereas Ethereum tends to have a take rate of ~80%.

What’s the difference between Revenue and Earnings?

- Earnings is calculated by subtracting (i) Token incentives and (ii) Operating expenses from the Revenue.

- Token incentives = an indication of how much the protocol spends on user acquisition. It’s calculated as the USD value of the protocol’s native tokens that have been distributed to users.

- Operating expenses = an indication of how much the protocol spends on personnel and infrastructure to develop, maintain, and improve the protocol.

- Note that a vast majority of protocols do not post their Operating expenses onchain, which is why that metric is yet to be added for most protocols.

When should you look at Fees vs. Revenue or Earnings?

- As a rule of thumb, investors should pay attention to Fees for early-stage protocols that have not started to monetize yet, and Revenue and/or Earnings for protocols that have started to monetize:

- Early-stage: Fees, indicates that the protocol has paying customers.

- Later-stage: Revenue, indicates that the protocol is able to monetize its paying customers.

- Mature-stage: Earnings, indicates that the protocol is able to return value to its tokenholders.

- It’s also important to look at the ratios between:

- Revenue / Fees = ideally, the protocol has so much leverage over its supply-side (LPs) that it can charge a high take rate on the Fees.

- Earnings / Revenue = ideally, the protocol operates with a (i) low user acquisition spend, and (ii) operational overhead, which leads it to retain a high % of Revenue as Earnings.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

- Customer stories: Token Terminal’s Data Partnership with Linea

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

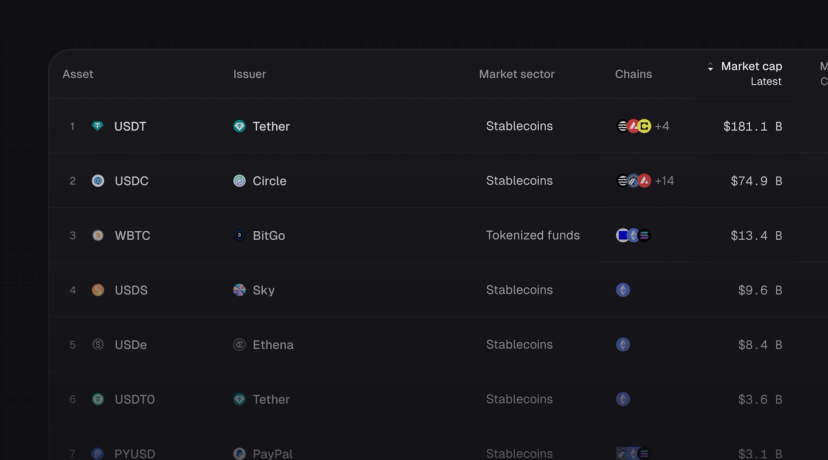

- Introducing Tokenized Assets

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

- Customer stories: Token Terminal’s Data Partnership with EigenCloud

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.