Newsletter

Fees – Weekly fundamentals #59

A walkthrough of the most interesting charts and trends in crypto, with a focus on key business drivers and protocol fundamentals.

This week’s newsletter focuses on fees, a metric that has a designated dashboard on Token Terminal. Let’s dig in!

Fees = value of aggregate fees paid by end users. Shows if users are willing to pay to use a protocol, i.e. if there is product market fit.

Overview

Below is visualized the top projects in all market sectors based on daily fees in the past 180 days.

Key takeaways

- In this report, we focus on the top fee-generating projects, where the most prominent market sectors are Blockchains (L1), Derivatives, and Exchanges (DEX).

- A noteworthy observation is that, despite the proliferation of projects with deployments across multiple chains, the majority of fees are still generated via contracts deployed on Ethereum.

- Among the highest fee-generating projects, all of the top five were established in 2020 or earlier, with Lido Finance as the most recent entrant and Bitcoin as the longest-standing participant.

Key takeaways

- Ethereum has consistently maintained its position as the top fee generator, outpacing competitors by a considerable margin.

- Although Ethereum's dominance remains unchallenged, we observe a gradual decline in its share of total fees paid within the crypto ecosystem. It is noteworthy that Tron, absent from the top 10 fee generators a year ago, is now vying for market leadership, bolstered by its widespread adoption in emerging markets.

- NFT marketplaces experienced a significant reduction in fee capture, with the total amount dwindling to a fraction of previous levels. OpenSea, in particular, has grappled with the repercussions of this trend and intensified competition from its rival, Blur.

- For an in-depth analysis of the NFT marketplaces sector, we recommend reviewing last week's newsletter.

Key takeaways

Momentum

Below is visualized the fees for the top projects, including both blockchains and decentralized applications, based on aggregate fees and growth rates.

Key takeaways

- Arbitrum stands out as the sole Layer 2 scaling solution among the top 20 projects. Driven by airdrop speculation and the subsequent launch of the ARB token, Arbitrum has experienced substantial fee growth on both 30-day (+103.3%) and 90-day (+378.0%) timeframes. It is also worth highlighting the increasing number of projects being built on Arbitrum.

- The success of Arbitrum has a direct impact on projects built on its platform, such as SushiSwap and Uniswap, both of which have seen increased fees on Arbitrum. A year ago, Uniswap's fees were 95% Ethereum-based; now, that figure has dropped to 75%, with fees from Uniswap on Arbitrum accounting for 20% of the total.

- SushiSwap's fee share from Arbitrum has similarly risen, from ~20% to ~60% over the past 180 days.

- In the past 30 days, the trading pairs WETH-ARB and ARB-USDC have generated $4.6 million and $2.8 million in fees for Uniswap, respectively. This activity level is notable given that the ARB token launched less than three weeks ago.

- dYdX recorded over three times the trading volume of GMX in the last 30 days ($37.2 billion vs. $11.2 billion) but only half the fees ($9.1 million vs. $18.2 million). One possible explanation is dYdX's tiered fee structure, which exempts small makers and takers, as well as larger makers, from fees. Additionally, dYdX offers fee discounts based on DYDX token holdings, whereas GMX maintains a fixed fee structure.

Key takeaways

- Level Finance, launched in late December 2022, has rapidly emerged as the leading derivatives protocol on BNB Chain. This rapid growth can be attributed to various incentives, including the loyalty program that distributes LVL rewards to traders based on their daily trading volume.

- Synthetix has demonstrated robust growth across the board, propelled by new product releases and the increasing traction of Perps V2 on Optimism.

- To gain further insights into the driving factors behind this growth, tune in to our 15-minute fundamentals episode featuring Synthetix's core contributors Mike and Matt.

- Uniswap, the market leader on Ethereum, has recently expanded to BNB Chain, while PancakeSwap, the dominant player on BNB Chain, has ventured into the Ethereum ecosystem. However, neither platform has succeeded in securing significant market share on their respective non-native chains.

- For more information on PancakeSwap's plans to expand its presence on Ethereum, listen to our 15-minute fundamentals episode with Mochi, the Head Chef at PancakeSwap.

- Lido's upward trajectory can be attributed to the rising price of ETH and an increase in users depositing assets into the protocol. Additionally, Lido's metrics received a significant boost in February when Justin Sun made a sizable deposit of 150,000 ETH.

- Venus has experienced a considerable surge in fees, attributable to large vBNB borrows associated with users borrowing vBNB to farm launchpool tokens.

Key takeaways

- Among the top five projects, Tron, Lido, and Uniswap have P/F ratios (circulating) below 10, whereas Ethereum and Bitcoin display notably higher ratios of 113.5 and 1,840.7, respectively. This discrepancy can be attributed to the distinct valuation dynamics of Lido and Uniswap, which as dApps can be valued based on future cash flows. In contrast, Ethereum and Bitcoin possess a broader range of use cases (store of value, internet-native currency, etc.), rendering purely cash flow-based valuations not directly comparable to those of dApps. Nevertheless, the P/F ratio remains a useful proxy for comparing projects within similar market sectors.

- Tron, dYdX, and Synthetix are unique among the top 20 projects as they capture 100% of user-paid fees as revenue. Ethereum, the leading fee generator, captures (burns) approximately 85% of total fees paid.

- Currently, Uniswap, Bitcoin, and Blur do not capture any fees as revenue.

Video of the week

In this episode of 15-minute fundamentals, we dive into the current state of Gauntlet with core contributor, Nick Cannon.

Timestamps:

00:00 Introduction

01:07 Gauntlet’s mission

01:55 What pain-points does Gauntlet solve for protocols and DAOs?

03:07 Overview of Gauntlet’s core product

03:30 How does Gauntlet work with DAOs in practice?

05:46 Case example: How does Gauntlet work with Aave?

07:34 Helping DAOs maintain sustainable business models

09:03 How does Gauntlet work under the hood?

13:52 Analyzing the market opportunity for Gauntlet

16:31 How does Gauntlet make money?

17:19 Current growth drivers and challenges

18:30 The team building Gauntlet

19:34 What’s next for Gauntlet?

Tweet of the week

Follow us on Twitter for daily updates

The Layer3 effect visualized.

— Brandon (@Brandon_M_Kumar) April 9, 2023

The vertical increase in Gnosis Chain activity is directly attributed to our latest quest.https://t.co/Tj8co0lPnB https://t.co/futWFuwJkK

Product tip of the week

Tips for getting the most out of Token Terminal

You can easily toggle between market sectors on metrics pages.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

- Customer stories: Token Terminal’s Data Partnership with Linea

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

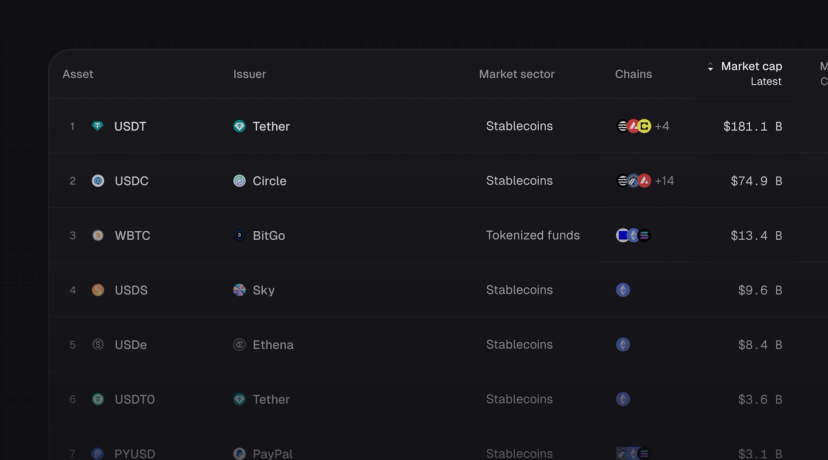

- Introducing Tokenized Assets

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

- Customer stories: Token Terminal’s Data Partnership with EigenCloud

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.